Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in May 2025:

- Bitcoin – The world’s oldest and largest crypto

- Hyperliquid – Decentralized perpetuals exchange with an efficient order book

- Zcash – Privacy-focused cryptocurrency

- Ethereum – The leading DeFi and smart contract platform

- XRP – The leading crypto remittance solution

- Solana – Smart contracts platform with high speeds and low fees

- Berachain – A unique Proof-of-Liquidity platform

- Sui – Robust and highly scalable L1 blockchain

- Stacks – A layer 2 platform for Bitcoin

- Raydium – Solana-based DEX and AMM with order book integration

- BNB – The native coin of the Binance exchange

- Hedera – Crypto network based on the Hashgraph algorithm

The best cryptos to buy right now: Discover top investments for May 2025

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 50% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin has extended its winning streak, setting new all-time highs at $111,978 and closing in the green for a sixth straight week. After climbing from $94,000 to over $111,000 in May, Bitcoin’s price action continues to outpace most major assets, and institutional conviction is only strengthening.

What’s remarkable is that Bitcoin’s ascent is happening against a backdrop of turmoil in global bond markets. Surging bond yields in the US and Japan signal deep investor anxiety over government debt and inflation, shaking confidence in assets once considered the world’s safest. As the US 30-year Treasury yield hits its highest levels since 2007, traditional “safe havens” are losing their appeal, and capital is flowing to alternatives like Bitcoin.

Bitcoin just had its highest daily candle close… ever. pic.twitter.com/6qGKYx8VwA

— The Wolf Of All Streets (@scottmelker) May 19, 2025

This shift marks a turning point in how risk is viewed: Bitcoin is now acting both as a high-growth asset and, paradoxically, a safe haven. Evidence of this changing narrative is clear, with spot Bitcoin ETF inflows reaching all-time highs and more institutional investors viewing BTC as a politically neutral store of value.

Corporate adoption underscores this trend. Metaplanet, dubbed “Asia’s MicroStrategy,” recently bought $104.3 million in BTC, bringing its holdings to 7,800 coins. Moves like this highlight how global players are betting that Bitcoin will thrive as the old financial playbook falters.

2. Hyperliquid

Hyperliquid is a decentralized perpetual futures exchange built to rival centralized trading platforms in speed, liquidity, and user experience—all while remaining fully on-chain. Unlike traditional DEXs that often struggle with performance bottlenecks, Hyperliquid uses a custom high-performance layer-1 blockchain specifically optimized for trading. This allows it to offer ultra-low latency, high throughput, and a seamless trading experience without relying on external validators or rollups.

One of Hyperliquid’s key innovations is its order book-based model, which is uncommon among decentralized platforms. While many DEXs use automated market makers (AMMs), Hyperliquid implements a central limit order book (CLOB), giving traders more control over order execution and tighter spreads. This design makes it particularly appealing to professional and high-frequency traders who expect the responsiveness of centralized exchanges but want the trustlessness of DeFi. Its deep liquidity pools and tight integration with crypto-native assets further enhance its trading dynamics.

Why Hyperliquid?

Hyperliquid is having its breakout moment. HYPE, the protocol’s native token, has soared above $38, mimicking the explosive price structure Solana showed in early 2021 before a legendary rally. Technical analysts now project a potential 240% gain by July if the current pattern holds, with Fibonacci extension targets at $51 and even as high as $128 for the most bullish scenarios.

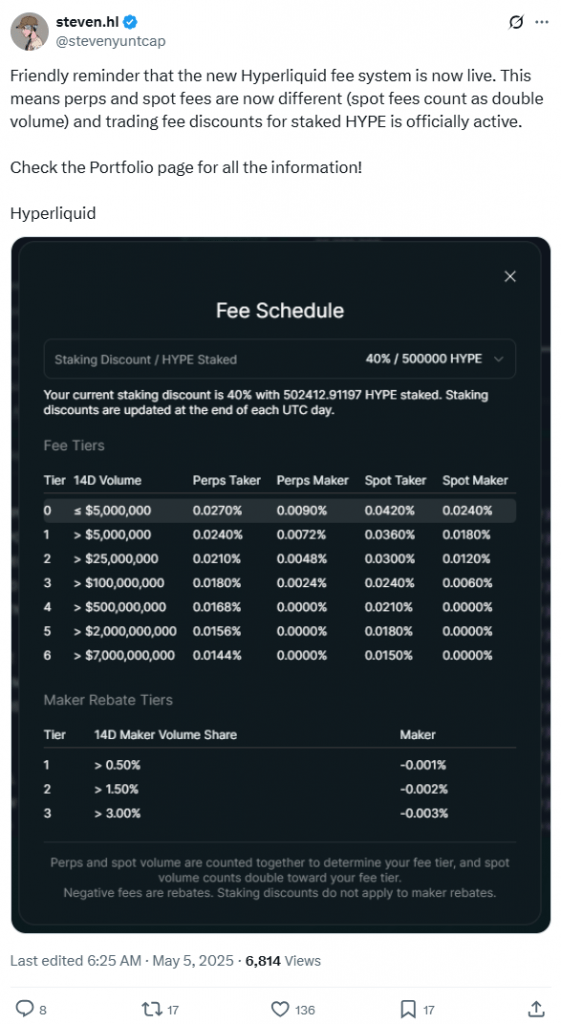

This price action comes on the back of sustained momentum. Hyperliquid recently upgraded its fee structure to reward staked HYPE holders, further reducing the circulating supply and incentivizing long-term participation. The platform regularly processes over $100 million in daily volume and has achieved speeds of up to 200,000 transactions per second—clear evidence of both technical excellence and real user adoption. [Insert tweet: Steven.hl or Ansem on Hyperliquid’s fee changes or protocol stats]

Hyperliquid’s recent launch of HyperEVM has turbocharged ecosystem growth, allowing over 100 decentralized applications to go live across DeFi, GameFi, AI, and more. Popular analysts are comparing Hyperliquid to “Solana and FTX combined,” but with the critical difference that nearly all trading revenue goes directly to HYPE tokenholders, and the protocol is fully onchain.

With momentum building, strong fundamentals, and an eye-catching chart setup, Hyperliquid is increasingly positioned as one of the most compelling short-term bets in crypto. If the “Solana fractal” narrative gains further traction, HYPE could be the next token to capture widespread trader attention.

3. Zcash

ZCash (ZEC) is a privacy-focused cryptocurrency that was launched in 2016 by Zooko Wilcox-O’Hearn. It is a fork of Bitcoin, designed to enhance privacy and anonymity for its users. Unlike Bitcoin, where transaction details (such as sender, recipient, and amount) are publicly visible, ZCash allows users to choose between two types of transactions: transparent and shielded.

Transparent transactions work similarly to Bitcoin, where all transaction details are recorded on the blockchain and visible to everyone. However, shielded transactions use a cryptographic technology called zk-SNARKs to allow fully private transactions. In shielded transactions, the details are encrypted, meaning that only the parties involved have access to the information, while the validity of the transaction is still verifiable by the network.

ZCash is particularly valued by those who prioritize financial privacy and security, as it offers optional anonymity in a way that few other cryptocurrencies do.

Why Zcash?

Zcash has re-emerged as a top privacy play, jumping over 23% in the last week and 51% in the past month as the privacy coin sector quietly reclaimed a $10 billion market cap. With most major cryptos pausing, privacy coins like Zcash are lighting up the charts, reminding investors that demand for financial anonymity hasn’t faded.

This momentum isn’t just about price. Zcash just achieved a major technical milestone with its integration into the Maya Protocol, a decentralized, cross-chain liquidity network. For the first time, ZEC holders can permissionlessly swap their coins across multiple chains—no centralized exchange or account required. In a climate where regulatory scrutiny is pressuring exchanges to delist privacy coins, this direct DEX access makes Zcash both more accessible and future-proof.

With ZEC now live on Maya Protocol, Zcash gains native access to a permissionless, decentralized, cross-chain liquidity network for truly decentralized asset swaps. This means ZEC holders can swap between assets with multiple chains without relying on centralized exchanges. https://t.co/5QaSiZFCPF

— Zcash 🛡️ (@Zcash) May 21, 2025

The partnership between Zcash and Maya is rooted in shared values—privacy, self-sovereignty, and decentralization. Unlike traditional platforms that require KYC and can ban assets at a moment’s notice, Maya enables truly open, censorship-resistant trading. Zcash’s upcoming Zashi wallet integration will take this further, bringing cross-chain shielded payments and Maya-powered swaps directly to mobile users in 2025.

With Zcash and other privacy coins gaining traction while liquidity remains limited due to centralized exchange bans, the Maya Protocol integration is a crucial hedge. It ensures ZEC users can move, trade, and spend—regardless of regulatory headwinds. In short: as privacy becomes harder to access, Zcash is building the tools and partnerships needed to keep it alive.

4. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

Ethereum has arguably been the most disappointing cryptocurrency during the 2024-2025 bull run. While Bitcoin, XRP, Solana, and BNB all posted immense gains, Ethereum was always lagging behind, with weaker gains and worse losses.

However, in the past two weeks, we’ve seen Ethereum bounce back, surging by around 30%. While it’s still around 50% removed from its ATH, investors predict that ETH could reach $3,000 by the end of May, stating that ETH “still has more gas in the tank”.

These gains came on the back of the long-awaited Ethereum Pectra upgrade, which brought numerous upgrades to the platform. These upgrades were mostly designed to improve the network’s performance and user experience.

#Ethereum might still have more gas in the tank ⛽️

The weekly Stochastic RSI suggests there's still room before reaching extreme overbought territory, possibly a few more weeks to go. #ETH pic.twitter.com/atCm93napO

— Titan of Crypto (@Washigorira) May 17, 2025

Additionally, the volume of stablecoins on Ethereum reached a new all-time high, surpassing $900 billion. This is especially true for USDC, which exceeded $500 billion in transactions. This surge in stablecoin activity comes as major institutions, tech giants, and even political figures like Donald Trump show increasing interest in crypto. Visa’s recent expansion of stablecoin settlements and PayPal’s push with PYUSD underscore the growing role of blockchain in traditional finance. Meanwhile, Ethereum continues to dominate as the primary chain for stablecoin transactions, far outpacing competitors like Tron.

5. XRP

XRP is a digital cryptocurrency that was created by Ripple Labs in 2012. It is used as a means of payment and transfer of value on the Ripple payment protocol, which is designed to enable fast and secure transactions between financial institutions as well as individuals.

XRP is unique in that it is not based on the blockchain technology used by many other cryptocurrencies. Instead, it uses a distributed consensus ledger called the XRP Ledger, which is maintained by a network of validators. This allows for faster transaction processing times and lower fees compared to traditional payment methods.

XRP has been popular among cryptocurrency traders and investors due to its high liquidity and clear potential for broader adoption, especially as a remittance solution. However, it has also been the subject of controversy and legal action, with US regulators alleging that it is a security and should thus be subjected to securities regulations. This has somewhat hindered the potential of XRP as an investment, and handcuffed Ripple’s growth as a company.

Why XRP?

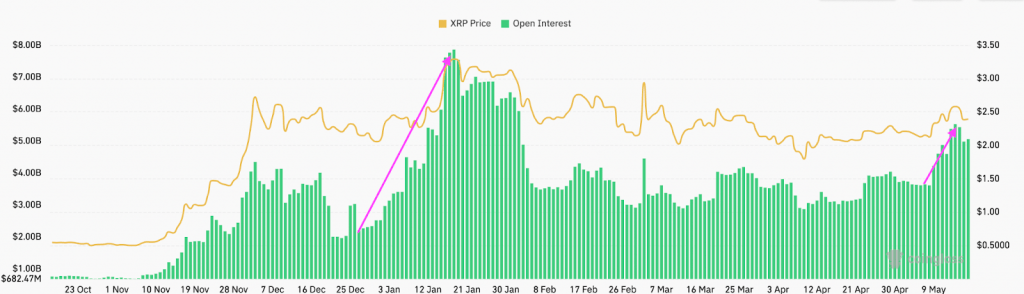

XRP’s long-term price trajectory remains intact despite recent market turbulence, with analysts pointing to a potential breakout toward the $3.40 mark. While the token has faced downward pressure alongside the broader crypto market, its current consolidation phase is viewed as a healthy setup for a sustained rally.

XRP futures open interest. Source: CoinGlass

Technical indicators, including a bullish continuation pattern and rising support trendlines, support the case for upward movement. Historical cycles also suggest XRP is mirroring past price behavior seen before major bull runs. If this pattern holds, the token could see significant gains as the crypto market regains momentum.

Fundamentally, XRP’s growing role in cross-border payments and ongoing legal clarity following its partial win against the SEC continue to strengthen investor confidence. Combined with a supportive macro backdrop and bullish sentiment building across altcoins, XRP is well-positioned for a potential breakout in the coming months.hat the main headwind XRP was facing is the Ripple vs SEC lawsuit, but that is now a thing of the past.

6. Solana

Solana is a smart contract platform known for its distinctive architecture, enabling it to handle thousands of transactions per second while maintaining very low costs. It accomplishes this by using a combination of a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL, the native cryptocurrency of the platform, is one of the cheapest to transfer, with users typically paying less than $0.001 per transaction.

Founded in 2018 by Anatoly Yakovenko, Solana’s mainnet went live in March 2020 and experienced a surge in adoption throughout 2021. Despite a significant drop in value during the 2022 bear market, Solana remains one of the most robust ecosystems in the cryptocurrency space and continues to be seen as a potential candidate for significant future growth.

Why Solana?

Solana presents a compelling opportunity for crypto investors at the moment, especially after a sharp price correction from its all-time high of $295 earlier this year. Currently trading at a roughly 40% discount, SOL is offering a potential entry point for those who believe in its long-term value.

Despite the broader market downturn that has impacted most altcoins, Solana’s fundamentals remain strong. On-chain activity is still remarkably high, with millions of daily transactions and active addresses. This consistent usage reflects a healthy and engaged user base, which is a critical indicator of network utility and long-term viability.

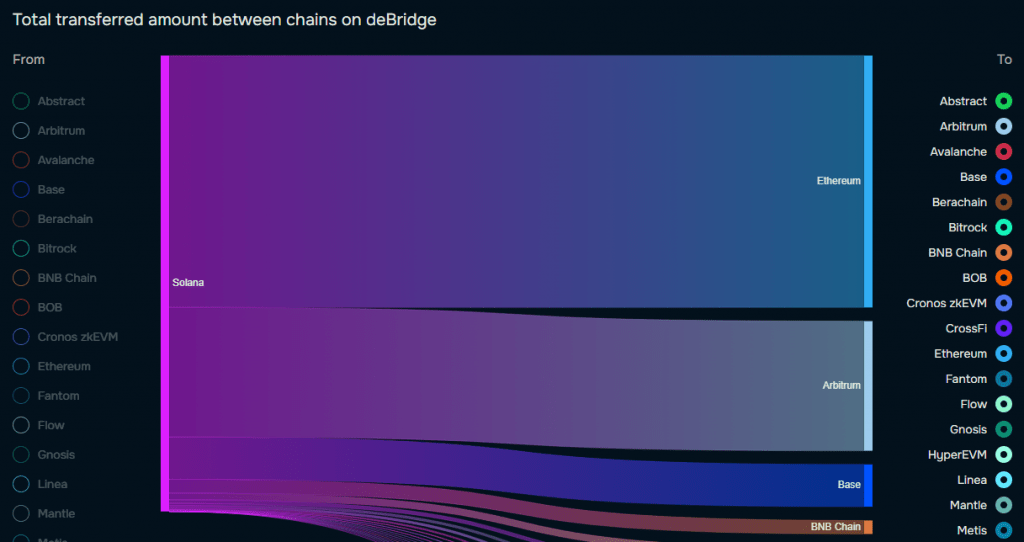

Over the past 30 days, Solana has attracted over $165 million in bridged liquidity from other blockchains – led by Ethereum with $80.4 million – signaling growing trust in the network. Alongside this, Solana recorded the highest DEX trading volume at $3.32 billion in the past 24 hours, capturing a dominant 28.99% market share among competing chains.

In addition, SOL has surged 18% this week, showing strong bullish momentum as it approaches a critical close above the 50-week EMA – a level that previously triggered a 515% rally in 2024. Historical trends, including RSI behavior and EMA breakouts, suggest a bullish setup that could push SOL to $250–$350 by September 2025 if momentum holds. A recent daily close above the 200-day EMA and potential breakout past $180 could spark a parabolic move in Q3 2025.

7. Berachain

Berachain is a Layer 1 blockchain that’s fully compatible with the Ethereum Virtual Machine (EVM) but introduces a unique Proof-of-Liquidity (PoL) consensus mechanism. Unlike traditional Proof-of-Stake systems, PoL rewards users who provide liquidity, aligning validator incentives with broader ecosystem growth.

The native token BERA is used for gas and staking, while governance is handled via BGT, a soulbound (non-transferable) token distributed to liquidity providers. This ensures that governance power stays with active participants rather than passive holders or speculators.

By embedding liquidity provisioning into its core architecture, Berachain aims to create a more engaged, sustainable, and DeFi-friendly blockchain ecosystem—offering a fresh approach to user incentives and network security.

Why Berachain?

Before the launch of Berachain in February 2025, the team launched the so-called Boyco App, which attracted a whopping $2.3 billion in pre-deposits. These pre-deposits were locked in Boyco Vaults for a period of 3 months (while generating anywhere from 1.6% to 18.5% APY), but will become unlocked as of Tuesday, May 6th.

The looming large influx of liquidity has already prompted numerous investors to sell their BERA as a defensive measure. “There’s over $2 billion in total waiting. And because of that, $BERA is dumping fast. Looks like whales are about to farm this one and move on to the next,” Hunters of Web3’s founder Langerius wrote on X.

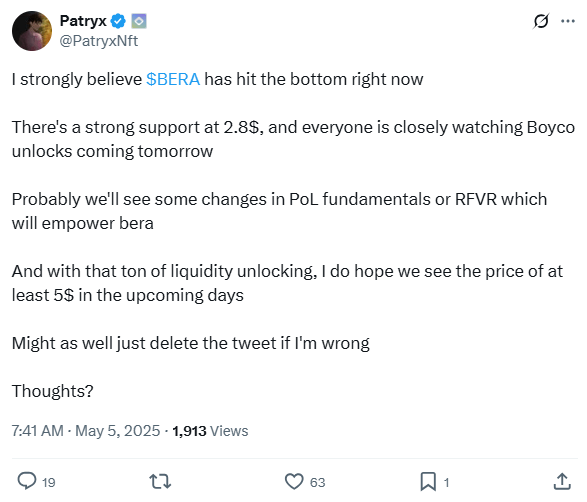

As a result, BERA lost 20% in the past week and nearly 50% between the start of April and the beginning of May. However, there’s reason to believe that BERA might have actually become oversold in this period, and the bottom is already in.

According to Roots’ executive Patryx, BERA has strong support at $2.8. Moreover, the analyst noted how a change in the Proof of Liqudity (PoL) could spark a fast and significant rally that could take the price of BERA to $5. It certainly is a risky play, but investors seeking high-risk, high-reward situations could benefit from the volatility expected in the BERA markets in the coming days.

For added context, following the success of Boyco, its pre-launch liquidity platform, Berachain’s mainnet launch saw over $2 billion in total value locked (TVL) — a clear show of confidence in the platform’s economic design. Moreover, Berachain has attracted serious capital, with $142 million raised in two funding rounds led by crypto-native VCs like Polychain Capital and Framework Ventures.

8. Sui

Sui is a layer 1 blockchain focused on scalability and high throughput. Thanks to its robust performance, Sui is positioned to become one of the leading chains in the Web3 and NFT space, challenging the likes of Ethereum and Solana.

Smart contracts on the Sui blockchain are written in the Move programming language, a language developed by a team of Facebook developers who worked on the Diem stablecoin project. Move was first prominently used by the Aptos team, which features a lot of individuals who worked on the Diem project before it was shut down.

The native token of the Sui blockchain is called SUI. The token is used to pay gas fees for transactions, staking, and compensating validators for securing the network, for funding Sui’s storage fund, and for the Sui ecosystem governance.

Why Sui?

Sui has rapidly gained attention following a 65%+ price surge in just one week, driven by strong speculation and real ecosystem growth. A major catalyst has been rumors linking The Pokémon Company to Sui through its acquisition of Parasol Technologies, which recently appeared in Pokémon HOME’s privacy policy update. Although no official confirmation has been made, the mere possibility of Pokémon exploring web3 initiatives through Sui has ignited massive interest in the project.

Beyond speculation, Sui is making meaningful strides in real-world adoption through a partnership with xPortal and xMoney. This collaboration enables over 2.5 million xPortal users to access a custom Sui wallet, spend SUI tokens at 20,000+ European merchants, and integrate with Apple Pay and Google Pay via a virtual Mastercard. With compliance, seamless UX, and real-world utility, Sui is positioning itself as a standout among layer 1 blockchains aiming for mainstream crypto payments.

Adding to its momentum, Sui’s broader ecosystem is also thriving, with projects like Suilend, DeepBook, and Navi Protocol posting triple-digit gains. These DeFi platforms highlight the growing liquidity and user engagement across the Sui network, suggesting that the recent rally isn’t just hype, but part of a deeper and expanding foundation.

9. Stacks

Stacks is a unique cryptocurrency designed to bring smart contracts and decentralized applications (dApps) to the Bitcoin blockchain. Unlike many other cryptocurrencies, Stacks enhances Bitcoin’s functionality without modifying its core code. It achieves this through a layer-1 blockchain that connects to Bitcoin, using Bitcoin’s robust security.

The innovative Proof-of-Transfer (PoX) consensus mechanism links Stacks to Bitcoin by using BTC to mint new STX tokens, rewarding participants who secure the network. This approach allows developers to build on Bitcoin’s stability and widespread adoption while enabling advanced functionalities such as DeFi, NFTs, and smart contracts.

Stacks is supported by Clarity, a programming language optimized for predictability and security, reducing the risk of bugs and exploits. By leveraging Bitcoin’s established infrastructure, Stacks aims to bridge the gap between Bitcoin’s long track record of reliability and the growing sector of decentralized applications.

Why Stacks?

Stacks is gaining momentum as a promising investment, fueled by the rising excitement around sBTC, a Bitcoin-backed token on its layer-2 network. A recent 25%+ weekly price surge has reinforced the $0.50 level as a local bottom, driven largely by BitGo’s announcement of institutional support for sBTC. With secure custody and infrastructure integration now available, BitGo’s involvement signals growing confidence in Stacks’ role within Bitcoin’s expanding DeFi landscape.

The upcoming launch of sBTC withdrawals on April 30 will further enhance the utility of Stacks by allowing seamless movement between BTC and sBTC. Unlike traditional wrapped Bitcoin products that rely on centralized custodians, sBTC offers a trust-minimized, decentralized bridge secured by smart contracts and validators. This innovative approach strengthens Stacks’ appeal as a more secure and scalable solution for Bitcoin-based DeFi.

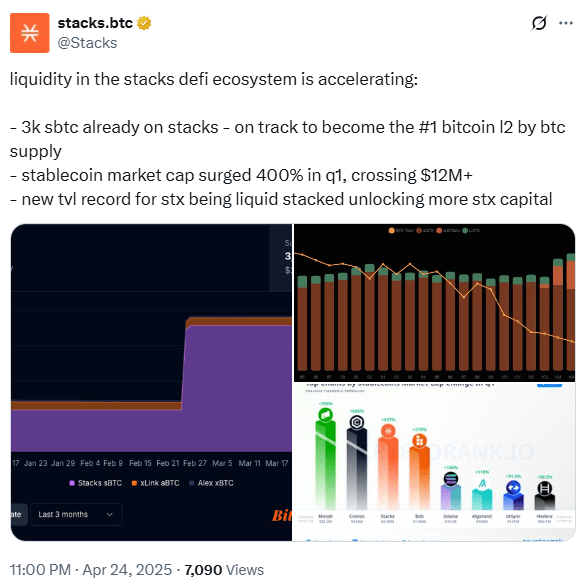

At the same time, liquidity across the Stacks ecosystem is soaring, highlighting deepening adoption. Over 3,000 sBTC have already been deployed, stablecoin market cap has surged 400% in Q1, and liquid stacking has pushed total value locked (TVL) to new highs. As liquidity and usage continue to climb, Stacks is positioning itself as one of the leading Bitcoin layer-2 networks, making STX a strong candidate for investors eyeing the future of Bitcoin DeFi.

10. Raydium

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain, designed to provide fast, low-cost, and efficient token swaps. Unlike typical AMMs, Raydium integrates directly with Serum, Solana’s order book-based DEX, giving it a unique hybrid model. This allows Raydium users to tap into the liquidity of Serum’s entire order book while also benefiting from the instant trades and yield farming features of traditional AMMs.

Raydium stands out for its capital efficiency and composability. Liquidity providers on Raydium not only earn fees from swaps but also gain exposure to broader market activity on Serum. Additionally, Raydium supports launchpads (via AcceleRaytor), dual yield farms, and ecosystem partnerships that help new projects bootstrap liquidity. Its ultra-fast transaction speeds—thanks to Solana’s architecture—make it a viable option for traders and projects seeking scalable DeFi infrastructure. The native token, RAY, is used for staking, governance, and participating in liquidity pools and launchpad events.

Why Raydium?

Raydium stands as one of the most important players in the Solana ecosystem, offering a dynamic blend of decentralized exchange functionality and liquidity provision. As the first AMM on Solana, Raydium has helped launch and support numerous projects by offering deep liquidity and a trusted launchpad. It holds a position similar to that of Uniswap in Ethereum’s early days, giving it a foundational role in Solana’s DeFi growth.

Built on Solana, Raydium inherits high-speed infrastructure with block times under 500ms and throughput of up to 65,000 TPS—far ahead of Ethereum’s capabilities. Since the start of 2024, the volume of trades on Raydium skyrocketed. At the same time, the total value of locked funds exploded, growing from $164 million TVL to over $1.2 billion TVL at the time of writing.

The technical edge, combined with income-generating features like staking and yield farming, makes RAY more than just a speculative asset. It’s a utility-rich token embedded in a growing ecosystem, appealing to both DeFi enthusiasts and long-term investors looking for exposure to Solana’s momentum.

11. BNB

BNB (formerly Binance Coin) is a cryptocurrency created by the popular cryptocurrency exchange Binance. Binance is the largest cryptocurrency exchange in the world, allowing users to buy, sell, and trade a wide range of digital assets.

BNB was initially one of the ERC-20 tokens on the Ethereum blockchain but has since migrated to its own blockchain, known as BNB Chain. BNB is used as a utility token within the Binance ecosystem and has a variety of use cases. For example, users can use BNB to pay for transaction fees on the Binance exchange, receive discounts on trading fees, participate in token sales on Binance Launchpad, and purchase goods and services from merchants that accept BNB as payment.

One of the unique features of BNB is that it has a deflationary model. Binance uses a part of its profits each quarter to buy back and burn BNB tokens, reducing the total supply of the token over time. This mechanism is designed to create scarcity and increase the value of BNB over time, with the end goal of reducing the circulating supply of BNB from the initial 200 million to 100 million BNB.

Why BNB?

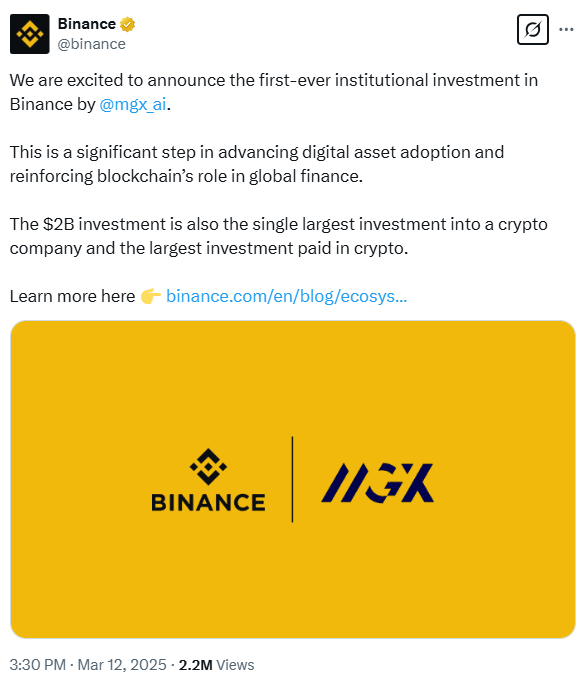

BNB has enjoyed quite a bit of market interest recently, having risen 13% between March 10 and March 17. There are several reasons for this, including the first-ever institutional investment in Binance and increased blockchain activity on the BNB Smart Chain.

On March 12, Binance announced that the Abu Dhabi-based investment firm MGX committed to a $2 billion investment in the crypto exchange giant. “MGX’s investment in Binance reflects our commitment to advancing blockchain’s transformative potential for digital finance,” said Ahmed Yahia, Managing Director & CEO at MGX, and added that as institutional adoption accelerates, “the need for secure, compliant, and scalable blockchain infrastructure and solutions has never been greater.”

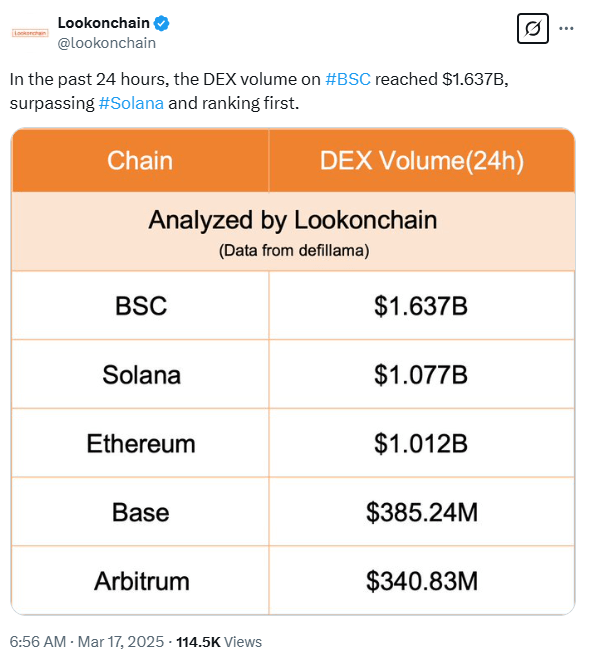

Meanwhile, the on-chain data shows that BNB Smart Chain has seen increased traffic when compared with other top smart contract platforms. As of March 17, BSC cleared over $1.6 billion in DEX trading volume, whereas Solana and Ethereum both trailed behind the first-placed BSC by roughly $600 million.

It’s worth noting that the price and blockchain activity recorded a notable increase since the February roadmap release for 2025. In it, the BNB Chain team highlighted low latency, more types of transactions, elimination of potentially malicious MEVs, and smart wallet features as the main updates slated for this year.

12. Hedera

Hedera (previously called Hedera Hashgraph) is a public distributed ledger and cryptocurrency platform that differs from traditional blockchain technology. Instead of a linear chain, it uses a directed acyclic graph (DAG) called “hashgraph” which allows for faster transaction speeds and higher scalability. This architecture enables Hedera Hashgraph to process transactions in parallel, significantly reducing the time and energy required compared to blockchains.

The platform supports smart contracts, file storage, and offers strong finality, with transactions confirmed within seconds. The native cryptocurrency of the Hedera network is HBAR. It is used to power decentralized applications, pay for transaction fees, and secure the network through staking. Hedera aims to provide a more efficient, secure, and fair digital economy, positioning itself as a next-generation platform for a wide array of applications.

Why Hedera?

HBAR has been one of the most impressive cryptocurrency performers recently despite the relatively poor performance over the past couple of days. When looking at longer time periods, HBAR’s performance is nothing short of impressive – the coin gained more than 520% over the past 3 months, which leads all major cryptos (apart from certain meme coins).

Last week, the Hashgraph Association announced a partnership with Taurus to enhance secure custody, staking, and tokenization of Hedera’s HBAR cryptocurrency and other assets. The collaboration aims to make Hedera’s ecosystem more accessible to financial institutions globally, focusing on regions with clear regulatory frameworks, such as Europe, Asia, the Middle East, and Africa.

In related news, Hedera co-founder and other higher-ups at the project attended the first ever “crypto ball,” a gala event celebrating Trump’s upcoming inauguration. In addition to Hedera, the event saw participation from notable individuals from other major US-based crypto projects such as Coinbase, Kraken, Ripple, Crypto.com, MicroStrategy, and many more.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $2.03 tln |

| Hyperliquid | HYPE | 2024 | Decentralized perpetuals exchange with an efficient order book | $12.41 bln |

| Zcash | ZEC | 2016 | Privacy-focused cryptocurrency | $861 mln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $289 bln |

| XRP | XRP | 2012 | The leading crypto remittance solution | $135 bln |

| Solana | SOL | 2020 | Smart contracts platform with high speeds and low fees | $83.4 bln |

| Berachain | BERA | 2025 | A unique Proof-of-Liquidity platform | $354 mln |

| Sui | SUI | 2023 | Robust and highly scalable L1 blockchain | $8.42 bln |

| Stacks | STX | 2017 | A layer 2 platform for Bitcoin | $1.25 bln |

| Raydium | RAY | 2021 | Solana-based DEX and AMM with order book integration | $875 mln |

| BNB | BNB | 2017 | The native coin of the Binance exchange | $93.9 bln |

| Hedera | HBAR | 2018 | Crypto network based on the Hashgraph algorithm | $6.62 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $500 million as of spring of 2025)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.