REX Shares may soon launch the first staked Solana ETF in the U.S. On June 27, 2025, the company sent a letter to the Securities and Exchange Commission (SEC) asking if all concerns had been addressed in its filings for Solana and Ethereum staking ETFs.

The SEC replied with no additional comments. That step suggests the process is moving forward. While formal SEC approval has not yet been announced, the lack of objections is a critical milestone.

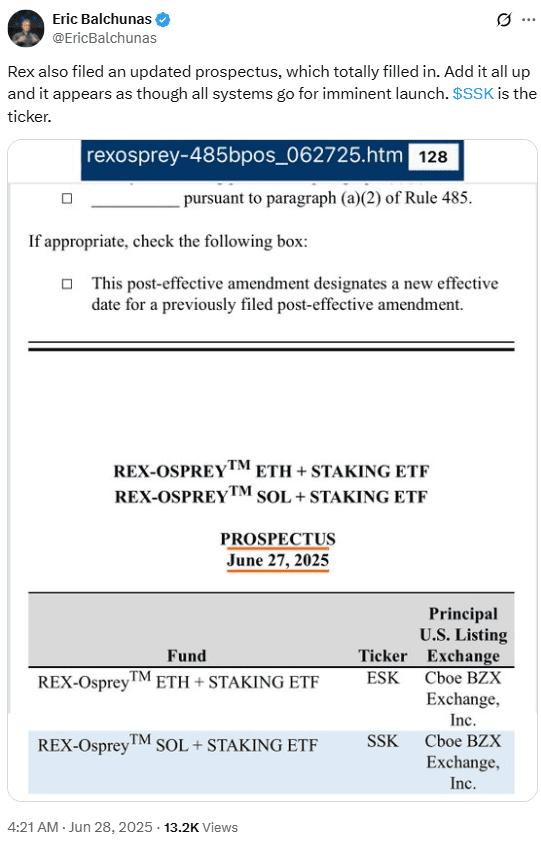

According to Bloomberg analyst Eric Balchunas, REX Shares also filed a fully updated prospectus. He said,

“Rex also filed an updated prospectus, which totally filled in. Add it all up and it appears as though all systems go for imminent launch. $SSK is the ticker.”

If approved, the $SSK ticker will represent the first crypto ETF in the U.S. offering both asset exposure and staking rewards through on-chain staking.

REX Shares Plans Staked Solana ETF With Yield Component

REX Shares confirmed that the staked Solana ETF will follow Solana’s price while also earning and distributing staking rewards. These rewards will come from on-chain staking activities involving locked SOL tokens. This allows the fund to generate income while tracking the token’s market value.

The proposed Solana ETF would operate by staking tokens on the Solana blockchain through validators. In return, it will receive rewards, which will be passed to ETF shareholders. This method uses the same network-level Solana staking process that secures the blockchain.

REX Shares has also submitted similar documents for an Ethereum staking ETF, though the current focus remains on Solana. The firm has already started referencing the $SSK ticker as the symbol for its proposed product.

This approach combines traditional ETF tracking with real-time blockchain-based yield collection. However, it does not include any bundling of extra services or early redemption offers, which may trigger securities laws.

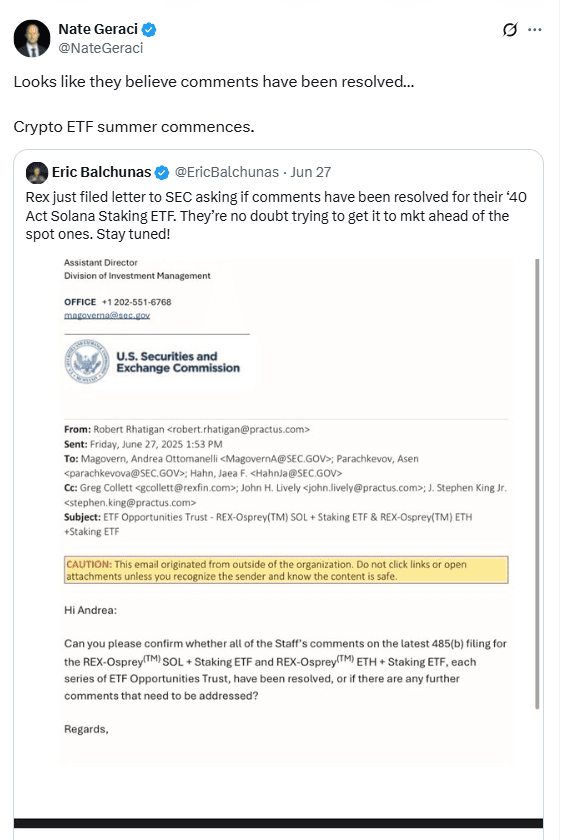

Analysts React to SEC Response on Staked Crypto ETF

The response from the SEC has caught the attention of industry analysts. Eric Balchunas called the lack of comment a strong sign of regulatory comfort with the proposed structure.

Nate Geraci, president of ETF Store, also commented. He stated,

“Looks like they believe comments have been resolved…Crypto ETF summer commences.”

His statement referenced the growing interest in crypto ETF filings following recent SEC updates.

The SEC approval process has shifted in recent months. In May 2025, the SEC clarified that staking models alone do not automatically fall under securities regulations. This opened a new path for firms like REX Shares to pursue staking-based ETFs without extra legal complications.

The Solana ETF by REX Shares is one of the first filings to benefit from this update. The agency explained that offering staking rewards by itself does not turn a product into a security. Only bundled services or extra investor options may do so.

SEC Guidance Helps Staked Solana ETF Move Forward

The SEC approval process has changed since the agency issued new guidance on staking. In its May 2025 statement, the SEC said on-chain staking without bundled services likely falls outside the securities definition.

This means products like the REX Shares staked Solana ETF may move ahead if they stay within the new boundaries. The agency’s guidance also noted that services like early withdrawal, reward guarantees, or packaging with third-party benefits may trigger extra oversight.

REX Shares’ filing includes clear details on how Solana staking rewards will be generated and passed through to investors.

If formal SEC approval arrives, REX will likely be the first firm in the U.S. to offer a crypto ETF that includes real-time staking rewards from a public blockchain. This places it ahead of other asset managers still pursuing spot-only Solana ETF proposals.

REX Shares remains in the lead for this category, with both its Solana staking and Ethereum staking ETF proposals in advanced stages of review.

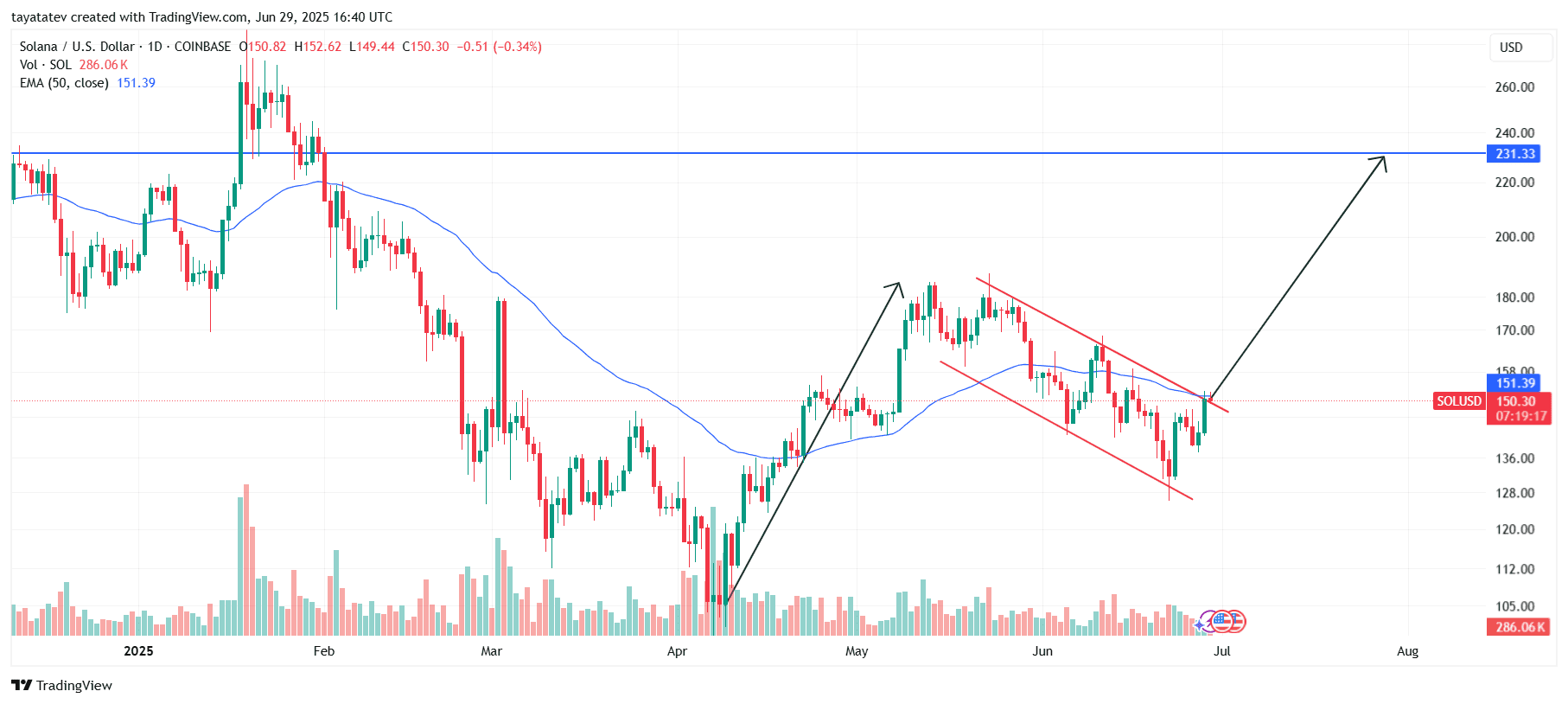

Solana Breaks Bullish Flag Pattern With 53% Upside Potential on June 29, 2025

On June 29, 2025, the Solana (SOL) / U.S. Dollar chart formed a bullish flag pattern, a classic continuation setup often seen after strong price moves. A bullish flag pattern appears when a cryptocurrency experiences a sharp rally (flagpole), followed by a downward-sloping consolidation channel (the flag) before resuming its upward trend.

In this case, the Solana price surged in late April and early May, forming the flagpole. It then entered a downward-sloping consolidation channel during June, creating the flag. This consolidation ended with a breakout above the upper resistance trendline of the flag, which occurred just above the 50-day Exponential Moving Average (EMA), currently near $151.39.

After breaking the upper boundary of the flag, Solana confirmed the bullish flag breakout. The breakout level sits near the current price of $150.30. By applying the measured move method—which involves projecting the height of the flagpole from the breakout point—Solana shows a potential upside of around 53% from the current price.

That move would target the $231.33 resistance level, as marked on the chart. This level also coincides with a previous significant resistance zone tested earlier in the year.

Price Structure and Technical Indicators

Solana has reclaimed the 50-day EMA with this breakout. Reclaiming this moving average typically signals regained short-term strength. The breakout candle shows strong volume, sitting at 286,060 SOL, which supports the move.

The breakout invalidates the lower highs and lower lows within the flag, shifting the structure into a higher high scenario. If volume continues rising over the next few daily candles, that would further strengthen this breakout.

In addition, Solana now trades in a rising trend, with momentum shifting upward. The next major technical challenge will be whether the price can maintain levels above the EMA and hold support at or above $151.

If these conditions hold, the bullish structure could remain intact in the near term, with a potential move toward $231.33 representing the 53% measured target from the breakout.